Companies that benefit by becoming a zone user or operator include manufacturing, distribution, and retail industries along with research and development firms. The common thread is that many of these are involved in international trade, receive imported products, manufacture, assemble, or test and scrap products before they are sold to consumers in the U.S. or exported to global consumers. Examples include:

Automotive parts manufacturers and many of their suppliers

Distribution companies and many third party logistics companies

Electronics assemblers or electronics manufacturing companies

Public warehouse operators

Local companies who import, manufacture or export goods

Retail consumer goods industry operating their warehouse facilities

These benefits make an FTZ one of the most effective tools for a business to become more competitive or a community to expand and recruit businesses. These benefits include:

Duty deferral – delay payment of duty until goods enter U.S. market

Duty Exemption – no duties on imported goods that are re-exported, destroyed, or scrapped

Inverted Tariff – choose whether to pay tariff on components or on finished product

Reduced processing fees – file a single customs entry per week rather than multiple entries

A Catalyst for Economic Growth

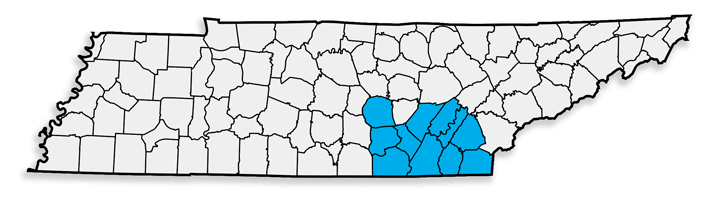

Foreign Trade Zones (FTZ) are a federal economic incentive program to enhance the capability of local companies to compete successfully in international trade. Businesses located in the FTZ service area receive customs related benefits allowing them to compete on a more level playing field with offshore companies. The Southeast Tennessee Foreign Trade Zone is an 11 county service area. FTZ benefits are available to businesses located at the Chattanooga Metropolitan Airport or can be extended to a business’ fixed site anywhere in the 11 county region.

Southeast Tennessee Foreign Trade Zone

The 11 county Southeast Tennessee Foreign Trade Zone is more flexible than many other FTZs in the country. It is organized under the Alternative Site Framework program. This designation allows businesses to activate anywhere within the 11 county region.

Is the Southeast Tennessee Foreign Trade Zone Right for Your Business?

Contact the Chattanooga Area Chamber of Commerce to help you determine the return on investment you can achieve through this program if any of the following apply to you:

You need to store imported goods, or show them to prospective buyers.

Your merchandise may be processed, cleaned, tested, relabeled, repackaged, scrapped or otherwise manipulated before it is released into the U.S. or exported.

Your domestic goods will be sold abroad and carry a high excise tax burden.

Some of your imported goods are damaged or destroyed, or some of the raw material you import is destroyed in the finishing process. Only pay fees on products that enter U.S. commerce.

Your final product is taxed at a lower rate than the imported materials used in production.

Your finished product is subject to U.S. quota restrictions.

You have a fixed site within the 11 county service area.

Business Benefits of the Southeast Tennessee Foreign Trade Zone

Businesses located at any fixed site in the 11 counties can become part of the FTZ program.

Businesses can be approved by U.S. Customs and Border Protection and Department of Commerce in 30 - 45 days.

Businesses can benefit from increased cash flow and inventory control.

An FTZ designation will allow a business to operate warehouses as a means to reduce operating costs, improve supply chain velocity and manage security at distribution facilities.

Users can defer, delay or eliminate payment of some duties and taxes on goods manufactured or processed within the FTZ.

Facts and Fictions Regarding FTZs

There are many myths about FTZs. The realities of the FTZ Program are that it provides communities and local companies a way to increase cash flow, remain competitive and expand job creation within a region.

FTZs only work for manufacturing companies. FALSE.

Companies in FTZs receive imported products, manufacture, assemble, test and scrap products before they are sold to consumers in the U.S. or exported to global consumers. The retail consumer goods industry is now operating warehouse facilities within FTZs.FTZs slow down commerce. FALSE.

FTZs allow businesses to keep production costs closer to the market while still receiving the reduced costs comparable to moving to a foreign market. The FTZ helps businesses reduce production, transaction, and logistics-related costs by lowering the effective duty rates and allowing special entry procedures. Goods that have a U.S. quota restriction may be stored onsite for quicker release into the stream of commerce.FTZs take work away from America. FALSE.

By reducing costs, FTZs level the playing field and improve U.S. competitiveness. The benefits of the FTZ program may be the competitive advantage companies need to keep their manufacturing or distribution operations in the U.S. By helping local employers remain competitive, zones can contribute to maintaining or boosting employment opportunities. The lower FTZ-based production costs encourage increased investment in U.S. facilities.FTZs have a negative impact on a company’s cash flow. FALSE.

FTZs allow businesses to manage cash flow by delaying, deferring, or eliminating duties and certain taxes on goods. Goods can be stored indefinitely at the FTZ site.

FTZs are expensive. FALSE.

Costs for activating a location within the FTZ vary depending on the security and inventory controls in place at the facility. The initial long-term duty deferral benefit to the business often exceeds the activation costs. The business also realizes ongoing benefits through delayed payment of duties and inverted tariffs. In addition, no duties are paid on re-exported products, waste, scrap, and rejected or defective products.FTZs are complicated and require a lot of new paperwork. FALSE.

FTZ users are often able to file a single customs entry per week rather than making multiple entries during the course of the week.FTZs are only for international companies. FALSE.

FTZs are for companies that either buy or receive imported products from foreign or domestic vendors or have merchandise that is processed, cleaned, tested, relabeled, repackaged, scrapped or otherwise manipulated before it is released into the U.S. or re-exported; or have domestic goods to be sold abroad that carry a high excise tax burden (such as beer, wine or spirits).FTZs are only allowed at port locations. FALSE.

The Southeast Tennessee FTZ is organized under the Alternative Site Framework program. This means that companies can activate at any fixed site with the 11 county service area.

Foreign Trade Zone Definitions

Operator

A company that performs or operates the zone and performs zone activities such as receipt, storage, handling, shipment, recordkeeping, reporting and marketing of the zone

A company that may operate warehouses which perform storage, manufacturing, distribution or other activities in the zone

A company that provides third party logistics services to local, regional, national or international firms

U.S. Customs and Border Protection

Responsible for the control of merchandise in a zone

Controls admission, activity and release of goods from a zone

Oversees procedures and compliance with all appropriate federal laws and regulations

User

A person or firm using a zone for storage, handling, manufacturing or assembly of merchandise

Foreign Trade Zone Board

Comprised of the Secretary of Commerce and the Secretary of the Treasury. The Board is chaired by the Secretary of Commerce. The Commissioner of U.S. Customs and Border Protection also plays a key role, even with the recent move from Treasury to the Department of Homeland Security, providing a position during the FTZ Board voting process with respect to customs security, control, and resource matters.

Grants authorization to establish, operate, maintain or expand zones

General Purpose Zone

An industrial park or airport or water port complex whose facilities are available for use by the general public.

Subzone

Fixed locations sponsored by the General Purpose Zone and are normally single purpose sites for operations that cannot be feasibly moved to, or accommodated in a General Purpose Zone.

Grantee

A private entity organized for the purpose of establishing a zone; the Chattanooga Area Chamber of Commerce is the grantee for the Southeast Tennessee FTZ #134

Responsible for maintaining public utility access to the zone for all users